The ACRES Advantage…Why invest in U.S. Private Real Estate?

“Ninety percent of all millionaires become so through owning real estate. More money has been made in real estate than in all industrial investments combined. The wise young man or wage earner of today invests his money in real estate.”

– Andrew Carnegie, billionaire industrialist

The Top 10 reasons to invest in U.S. Real Estate

1. U.S. Real estate is welcoming to foreign investment

If you’re a non-U.S. resident looking to own investment properties in the country, you’re in luck. The housing market in the United States has always welcomed foreign property investors and provided them with a friendly business environment across all 50 states. As a matter of fact, the United States is the single largest recipient of foreign direct investments (FDI) and cross-border capital in the world. According to the Bureau of Economic Analysis at the Department of Commerce, the US received more than $450 billion of foreign investments over the last few 2 years!

2. U.S. Real estate provides a stable market and strong economy

Among things that attract foreign investors to the United States are its transparent legal system, low taxes, outstanding infrastructure, and access to the world’s most lucrative consumer market. In addition, the American government doesn’t maintain restrictions or charge hidden fees to non-US residents seeking out a home or an investment property in the country. Thus, a foreign real estate investor has the ability to operate with relative freedom in the U.S.

3. U.S. Real estate is a safe haven for foreign investment

With a population of over 300 million people and a comparatively qualified workforce, the United States has one of the world’s strongest and most stable economies. With respect to real estate investing, this leads to increasing demand and provides property investors with great opportunities.

Now, more foreigners buy investment properties in the United States because they see the country as a safe haven for their capital, as opposed to their home countries which might be facing difficult economic conditions. At the same time, the U.S. housing market is distinguished for its large scale and liquidity, providing foreign investors with the flexibility to exit their investments if they decide to invest their capital elsewhere.

4. U.S. Real estate has a high tangible asset value

There will always be value in land, and value in housing. Other investments can leave you with little to no tangible asset value such as a stock which can dip to zero, or a new car which decreases in value over time.

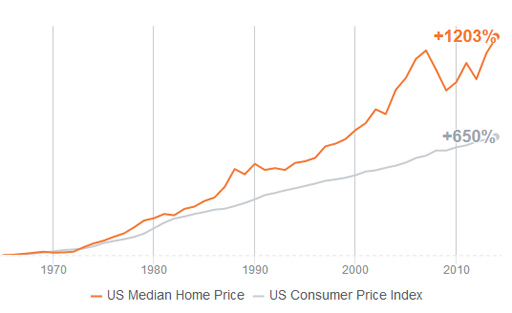

5. U.S. Real estate protects against inflation

Inflation may scare economists, but for real estate investors, it can actually be an advantage. While returns on assets like bonds can be undervalued due to inflation, real estate generally keeps pace with it. This is because home and rent values usually increase during times of inflation, matching the rate at which the value of the dollar drops.

6. U.S. Real estate values have always increased over time.

History continues to prove that the longer you hold onto your real estate, the more money you will make. The housing market has always recovered from past bubbles that caused home appreciation to slip, and for those who held on to their investments during those uncertain times, prices have returned to normal, and appreciation is back on track. Now, real estate investors in the top performing markets are enjoying a windfall.

7. U.S. Real estate builds wealth

Not only is property a tangible asset, but renting it out will also put money in your hands every month. Rental properties helps generate an ongoing income source and can be part of an overall strategy to build wealth. Unlike other investments that need to be cashed in, owning real estate gives you money that you can use today. After these funds accumulate, it can be used to buy other properties and grow your investment portfolio. Moreover, people will still need homes to rent during times of economic unrest (as they may have trouble purchasing homes themselves), so your investment may even pay off in times of overall financial strain.

8. U.S. Real estate gives you more control

While the appreciation of the value of certain assets depend on external markets, real estate is dependent on what you do with it. For example, you may not know if a company you’ve invested in is about to hire a new CEO whose decisions will ultimately drive the price of their stocks down. However, you can choose where to buy your property, how much you want to renovate it, who you want to rent to, and how much to invest in the upkeep; all of which can determine how good your investment is. In other words, the ability to profit from your real estate investment lies in your hands.

9. U.S. Real estate can also diversify your portfolio

If you’ve ever spoken to a financial planner about investing, then you are very aware of the importance of diversification. When you diversify your portfolio, you spread out the risk. Real estate will always serve as a safe tangible asset to mitigate the risk in your portfolio. Many have amassed wealth by solely investing in real estate.

10. U.S Real estate generates high passive income

The number one reason to invest in real estate is to generate a passive income for yourself so you can enjoy more of the things you want. However, not all real estate investments are created equal. ACRES has made the investing process seamless and simple by choosing only the best revenue-producing properties in the United States. Our unique approach to real estate investing enables you to invest your hard-earned money in real estate markets that have seen continuous and stable growth, thereby giving you continuous passive income.

The Bottom Line

When it comes to real estate investing, there are few countries that are as welcoming and kind to foreign investors as the United States. There are significant advantages to real estate investing in the U.S. housing market that keep on attracting more and more foreign investments. These include a safe and stable market economy, available financing, tax benefits, and ability to receive a better return on investment. Therefore, if you’re thinking of diversifying your investment portfolio through purchasing investment properties, making your purchase in the United States is a great idea.

Regardless of your net worth, you can now benefit from real estate’s unique potential for generating consistent cash flow and long-term appreciation. Something that was previously reserved for only the wealthiest investors and institutions.

U.S. Real Estate – The Best of the Best

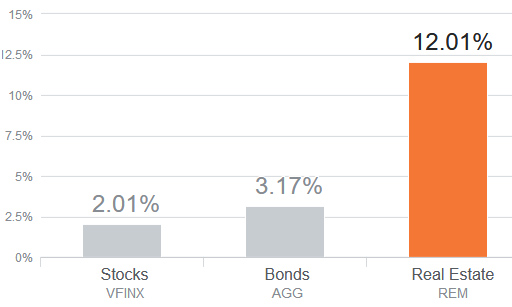

Institutional investors have long known that Private Commercial Real Estate ( PCRE) compared to publicly traded real estate and stocks have produced superior income returns.

Moreover, PCRE has provided diversification with far less volatility. Investing with ACRES means investing in individual properties through a pooled investment vehicle. As PCRE is not publicly traded, it is not subject to the same stock market volatility responsible for much of the fluctuation in the share prices of publicly owned (public) real estate. From 2008–2017, 79% of public real estate returns were correlated to S&P 500 returns, up from a correlation of about 31% over the previous decade. Meanwhile, PCRE correlated only to 17% of S&P 500 returns over the past two decades.

Regular Cash Flow

Unlike most stocks, Private Commercial Real Estate generates consistent cash flow (income) from rent. For investors looking for regular income from their portfolio, PCRE can provide an attractive alternative to bonds, which also generate regular cash flow, but generally at much lower rates.

Intrinsic value

Real estate is a hard asset – it provides intrinsic value through its use as a home, office, factory, etc. Real estate is also scarce. There is only so much land in a given area. As cities grow, demand for real estate increases, yet supply is limited by geography. This is why real estate assets have historically appreciated in value over time.