“To be successful in real estate, you must always and consistently put your clients’ best interests first. When you do, your personal needs will be realized beyond your greatest expectations.”

– Anthony Hitt, Real Estate Professional

Investment Objective

American Capital Real Estate Solutions (ACRES) targets, undervalued stable U.S. property investments that not only have great potential for high cash flow, but which also demonstrate strong prospects for near and/or mid‐term value creation through our rigorous asset management.

◦ Current cash flow is expected to generate approximately two thirds to three quarters of the total return for our investors.

◦ Acres believes the ability to collect and manage current and more predictable operating cash flow, as opposed to primarily relying on future capital appreciation, greatly reduces the risk profile of its real estate investment approach.

Executive Summary

Building on management’s successful track record and strong reputation, ACRES is now raising a $50 million private equity debt offering that will continue and expand our real estate investing strategy. We will offer the most attractive risk-adjusted returns to our investors through a balanced combination of current yield and capital appreciation potential.

Fund Size: Up to $50 million USD

Market: United States

Strategy: Undervalued / High Income properties

Investment Sectors: Single Family / Multifamily / Apartments

Targeted IRR: 8-16%

Investment Duration: 1-5 years

Years of Experience

ACRES key competitive advantage is its management team and in-house platform that adds value at every step of the property investment process.

Management has acquired, rehabilitated and managed a multitude of diversified assets for over two decades. And over that time, we have developed an unparalleled expertise in owning and operating income producing properties.

Past Management Performance:

Value of Assets: $

Properties Purchased: $

Properties Managed: $

IRR Return: %

Yield: %

Leadership Team

Roberto Larrivey, President

22 years of Real Estate Sales/Acquisition and Property Management Experience

Joseph Zawacki, Chief Financial Officer

24 Years of Financial auditing and Operational Experience

Blair Baker, Vice President

18 Years of Banking and Investment Analysis Experience

How We Work

Sourcing: Acres utilizes its experience and strict underwriting focus to target only the most attractive opportunities.

Underwriting: ACRES has the ability to rapidly underwrite small to large and simple to complex real estate transactions and financing. Providing quick answers to take advantage of prime opportunities.

Managing: ACRES in house property management & operations team, led by industry veterans provides disciplined, superior property services that drive growth.

Selling: ACRES has in-depth knowledge of the single family home and multifamily marketplace with experience over multiple economic cycles.

Property Acquisition

ACRES dedicated acquisition team sources the full spectrum of single and multifamily investment opportunities through it’s deep network of personal contacts, brokers and banks. Our Three person acquisition team sources and evaluates approximately 1000 investment opportunities per year to find the very best.

Market Outlook

Market conditions make this the perfect time to be investing in undervalued U.S. real estate assets.

◦ Exposed by the unfolding financial downturn, many investors opt for tangible assets.

◦ Investment interest in U.S. real estate for wealthy individuals, will continue to grow.

◦ Stock market uncertainty. In the midst of the longest bull market run in history, U.S. stocks are expected to return a fraction of what they have in the past with greater volatility.

Supporting Trends

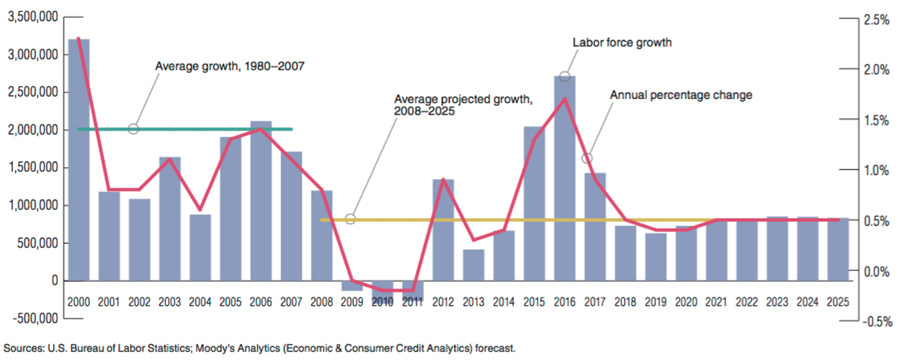

Growing Demand

The United States growing population and stable economy are creating demand for new housing and jobs that can support a robust and growing middle class.

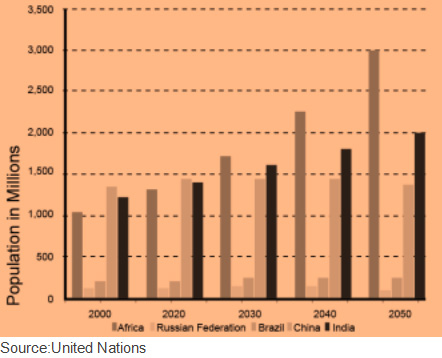

Population Growth

The trajectory of key population and economic drivers underscores the enormous opportunity available for investments.

The trajectory of key population and economic drivers underscores the enormous opportunity available for investments.